|

|||||||||

Instant Home Searches

Quick Links |

As you saw in part 2 and part 3 of our series on flood insurance,

the flood zones as defined on the official Flood

Insurance Rate Maps (FIRMs) are a huge factor in

determining flood insurance rates. Be aware that FIRMs

are periodically reviewed and updated. Doing this is a

long and complex process, in which scientists study the

elevation and topography of the land, the adjacent bodies

of water, manmade developments, etc. All this produces

(hopefully) a map which indicates the likelihood of

flooding in any given area. Flood maps and flood zones

are very controversial, because sometimes it seems that

areas which have never flooded are considered high risk

zones, and vice versa. Nevertheless, the federal flood

maps are the official standard used. As you saw in part 2 and part 3 of our series on flood insurance,

the flood zones as defined on the official Flood

Insurance Rate Maps (FIRMs) are a huge factor in

determining flood insurance rates. Be aware that FIRMs

are periodically reviewed and updated. Doing this is a

long and complex process, in which scientists study the

elevation and topography of the land, the adjacent bodies

of water, manmade developments, etc. All this produces

(hopefully) a map which indicates the likelihood of

flooding in any given area. Flood maps and flood zones

are very controversial, because sometimes it seems that

areas which have never flooded are considered high risk

zones, and vice versa. Nevertheless, the federal flood

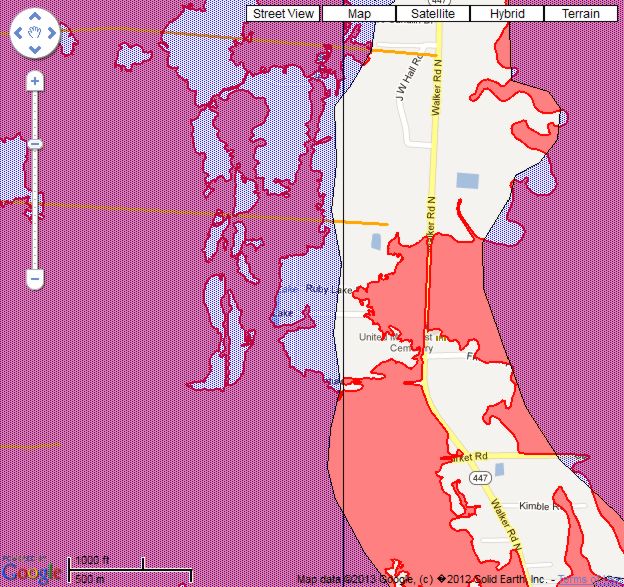

maps are the official standard used.Since these maps change periodically, that means the flood zone designation for a given location can also change. This can be a good or a bad thing. It is possible that a house which had been in a high risk zone is now located in zone X on the new map. More often, it seems that the opposite occurs. A house which may have been in flood zone X for years could suddenly fall into zone AE, meaning flood insurance would be required. This happened to our own house with the new Livingston Parish flood map which came out in April 2012. However, since we already had a policy in place, we are allowed to keep it and receive the preferred (low-risk) rate, at least until the government changes its mind. The flood map shown here is for a portion of north Walker. White areas are flood zone X; blue areas are the high risk zones (AE) according to the 2001 flood map; red areas are the current high risk zones from the 2012 map. Note how some areas improved while others got added to the high risk zones. When flood maps change, the base flood elevation (BFE) for a particular area can also change. If it is determined to be higher than it was before, that can have a massive impact on the cost of flood insurance. As we discussed in part 3, rates are determined by how high (or low) a house lies relative to the BFE. If a house was at +2, and the new map raises the BFE by 2.5’, the insurance would go from a few hundred dollars a year to a few thousand! When a home is reclassified as being in a high risk flood zone, the lender will require the owner to purchase a flood insurance policy if there is not already one in place. Currently, they are allowing such homes (like ours) to either continue or purchase a policy at the preferred rate, as long as certain requirements are met. Click here for details. This is a special form of “grandfathering.” Other types of grandfathering are currently allowed. Owners of houses built before a FIRM existed for that location can elect to pay a “pre-FIRM” rate instead of getting a flood elevation certificate and paying the standard rate based on that elevation. Houses which were built above grade at the time of construction (builders are not allowed to construct homes which lie below the base flood elevation) but whose elevations are later changed on new flood maps can also receive a grandfathered rate. Grandfathering is a good, sometimes absolutely necessary, choice for homes which otherwise would have very high standard rates. Unfortunately, grandfathering may soon be coming to an end! The Biggert-Waters Act was recently signed into law. The short version is that the federal government wants to discontinue all forms of grandfathering for flood insurance! No matter how high it would make the cost for the homeowner, they want all flood insurance policies to be based on standard rates elevations. Many people are in an uproar about this. Homeowners in some areas are being told that their policies are soon going to cost tens of thousands of dollars per year! If implemented, this would be a catastrophic blow to a lot of homeowners, as it would make their homes unaffordable for themselves along with anyone who might want to buy them. This is an impending disaster. In our opinion: With Biggert-Waters, the federal government is pulling the rug out from under hardworking American homeowners. We can understand them not wanting to keep paying out billions in flood claims on risky properties. However, we believe they should not have gotten into the insurance business in the first place! Now that they are though, they should honor the promises they made on existing homes. If they want to avoid insuring high-risk properties, they should do so from here on out, but NOT penalize homeowners who trusted them to provide the coverage they promised. In conclusion:

|

||||||||

| Did you find this topic

informative? If so, then click

to share it on Facebook. |

|||||||||

All images and

content Copyright © 2013 Greg and Danielle Bunch. All

rights reserved. |

|||||||||